nevada estate tax return

Do I have to file the Commerce Tax return. Nevada has the 13th highest combined average state and local sales tax rate in the US according to the Tax Foundation.

Right click on the form icon then select SAVE TARGET ASSAVE LINK AS and save to your computer.

. If your Nevada gross revenue during a taxable year is over 4000000 you are required to file a Commerce Tax return. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing. Since Nevada does not collect an income tax on individuals you are not required to file a NV State Income Tax Return.

In 2014 the exemption amount is 5250000. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. Taxes are subject to a 10 penalty if payment is.

But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates. So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value.

It gets paid out of the estates funds. With it you can manage your own tax account anytime anywhere and without the hassles of visiting the post office or coming into a Department Field Office. Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate value meets or exceeds the level requiring a Federal Estate Tax return.

Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author. This page contains basic information to help you.

Federal State Contact Information. However you may need to prepare and e-file a 2021 Federal Income Tax Return. Nevada tax information and contacts can be found in the table below.

Their hours are 7am to 7pm Monday through Friday Pacific Time. Normally a federal estate tax return is only due if the gross estate plus the amount of any taxable gifts exceeds the applicable exclusion amount up to 117 million in 2021. If the gross estate exceeds the exemption amount at time of death a Federal estate tax return Form 706 must be filed and any tax due paid within nine months after the date of death.

Our secure system is ready to go. If a death occurred after January 1 2005 you do not need to file an estate tax return with the state. It is essential to consult with a tax advisor on the filing of a 706 estate tax return.

Re-open the form from your saved location with Adobe Reader or. If you have any questions about state taxes you can contact the Nevada Department of Taxation at 866-962-3707. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Nevada TX.

The personal representative of every estate subject to the tax imposed by NRS 375A100 who is required to file a federal estate tax return shall file with the Department on or before the federal estate tax return is required to be filed any documentation concerning the amount due which is required by the Department. There are two kinds of taxes owed by an estate. Department of Taxation 1550 College Parkway Suite 115 Carson City NV 89706.

Nevada is one of the seven states with no income tax so the income tax rates regardless of how much you make are 0 percentBut the state makes up for this with a higher-than-average sales tax. Start Federal Income Tax Return Nevada Tax Facts Information. The federal estate tax exemption is 1118 million for 2018.

Nevada State Personal Income Tax. If you have any questions about federal taxes you can contact the IRS at 800-829-4933. Department of the Treasury.

The returned declaration will be processed by the appraisal and billing staff as the declaration is received. Is a true correct and complete return. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser.

The appraisal staff may conduct field verifications of any data on the completed declaration. I am a small business owner and my revenue is less than 4000000. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706.

4810 for Form 709 gift tax only. 8192005 31444 PM. Nevada currently does not have an estate tax.

NevadaTax is our online system for registering filing or paying many of the taxes administered by the Department. Starting 2018-2019 tax year there is no Commerce Tax filing requirement for the businesses with the Nevada gross revenue of 4000000 or less. The estate tax is on the estate of the deceased person before the inheritance gets disbursed.

Nevada does not have an inheritance tax either. All we need is you.

2022 No Tax Return Mortgage Options Easy Approval

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Understanding The 1065 Form Scalefactor

2022 Filing Taxes Guide Everything You Need To Know

New Jersey Tax Forms 2021 Printable State Nj 1040 Form And Nj 1040 Instructions

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

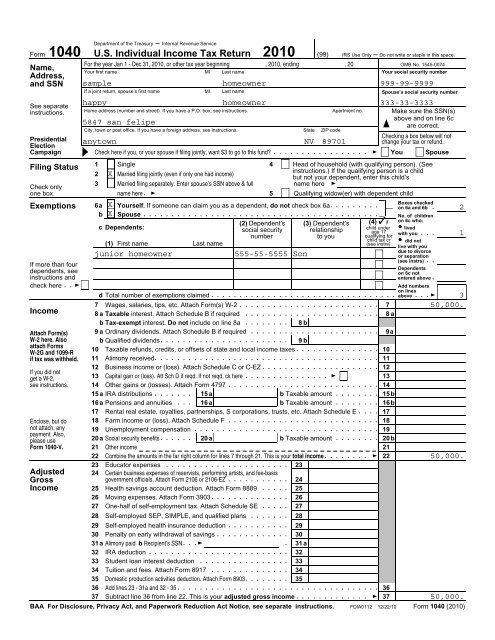

Sample 1040 Tax Return Nevada Rural Housing Authority

Tax Form Templates 5 Free Examples Fill Customize Download

Filing Taxes For Deceased With No Estate H R Block

How To File Llc Taxes Legalzoom Com

Double Taxation How Small Businesses Can Avoid It Smartasset

/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

You Made A Mistake On Your Tax Return Now What

Six Tax Answers For Two State Residents Military Com

There S A Tricky Virtual Currency Question On Your Tax Return

Irs Tax Penalties Tax Lawyer Tax Attorney Family Law Attorney